WITH $94,000 IN IMPACT, THE BTC CONTINUES TO FACE A RISK BIAS TEST (01.05-01.11)

THE SCALE OF THE SALE HAS INCREASED, BUT THE PURCHASING POWER HAS INCREASED, WITH THE CENTRALIZED EXCHANGE NETTING OUT NEARLY 25,000 BTCS。

The information, views and judgements on markets, projects and currencies referred to in this report are for information purposes only and do not constitute any investment proposal。

THIS WEEK, BTC WAS OPENED AT $9149.04 AND RECEIVED $90872.01, REPRESENTING A DECREASE OF 0.68 PER CENT AND AN AMPLITUDE OF 6.15 PER CENT, WITH A MORE MARKED INCREASE IN TURNOVER THAN LAST WEEK。

AS REPORTED EARLIER, THE BTC HIT A FURTHER $94,000 THIS WEEK, DRIVEN BY THE CONTINUED IMPROVEMENT IN THE FEDERAL RESERVE’S LIQUIDITY AND THE UNITED STATES EMPLOYMENT DATA MEETING EXPECTATIONS OF A “SOFT LANDING”。

HOWEVER, AS A RESULT OF THE FALL IN INTEREST RATES IN JANUARY, THE RISK PREFERENCE FOR IN-SITU FUNDS CONTINUED TO DETERIORATE, REACHING A LEVEL OF $94,000. THE BTC ETF AND THE LONG-HANDED GROUP INCREASED THEIR SALES AND RETURNED TO A FAILED POSITION AND HAD TO RETREAT AGAIN FOR $900。

AT PRESENT, THE BTC AND THE ENCRYPTION MARKET ARE STILL IN THE GRIP OF A BURGEONING SITUATION. NEW PURCHASING MOODS, OR AN OVERALL RISK PREFERENCE, MAY ALLOW BTC TO BREAK THROUGH $94,000 TO FURTHER EXPAND THE REBOUND SPACE。

ON THE TECHNICAL INDICATORS, THE BTC HAS BEEN IN A FAVOURABLE POSITION TO TAKE BACK THE PRICE RISE, AND THE 60-DAY AVERAGE HAS A STEADY TREND, SUCH AS NO NEGATIVE EXTERNAL SHOCKS, PRICES OR SHORT-TERM PENETRATION OF $94,000, CHALLENGING $95,000 IN THE 90-DAY AVERAGE。

Policy, macro-financial and economic data

The monthly economic data published by the United States this week are the first since the normalization of the data and are therefore very important in view of the stagnation of the Government, but the final outcome does not exceed market expectations。

On 8 January, the data published on the initial unemployment benefit showed that the number of applicants for the week was 20.08 million, a small amount lower than expected and prior. The light-interested venture assets, but meeting the “soft landing” expectations, show greater economic resilience。

On 9 January, the non-farm employed population in the United States, after the December season, was announced at 50,000, down from the expected level of 60,000 and the previous value of 56,000, but the unemployment rate was only 4.4 per cent, a small percentage below the expected value of 4.5 per cent. The increase was 3.8 per cent, higher than expected, at 3.6 per cent. The seemingly “conflict” employment data show that the job market is less crisis-prone than expected, which reduces the probability of falling interest rates in January, as shown by Fedwatch, to single digits。

This week's data reinforces the consensus that the economy is landing softly and that employment is getting colder. The U.S.A., the main global capitalist, continues to be strong, with S& the P 500 and Dow Jones indices at an all-time high, and the 188 per cent increase in the number of navigators questioned because of overinvestment in AI is approaching its pre-historic high. There are signs of a shift in capital from the science and technology unit to the consumption unit, the value unit, and the small and medium capitalization stock。

10 ANNUAL UNITED STATES DEBT OF 4.173 PER CENT WITH A REAL RATE OF RETURN OF 1.91 PER CENT CONTINUES TO PLACE CONSIDERABLE PRESSURE ON LONG-LIVED ASSETS SUCH AS THE TECHNOLOGY UNIT AND THE BTC。

Encryption Market

MACRO-LIQUIDITY IS IMPROVING, BUT NOT YET SUFFICIENT, AND HIGH-RISK ASSETS ARE STILL BEING SUPPRESSED. AI'S TECHNOLOGY UNIT IS STILL BEING SUPPRESSED, AND THE BTC IS NOT GIVING IN。

At the financial level, it can be seen that cyclical and short-term funding is still at a high point of exit, while long-term allocation is at a low level of delivery and is now in a fragile balance。

This week, as prices rebounded to the high of the previous period, the wave of sales resumed before major economic and employment data were released。

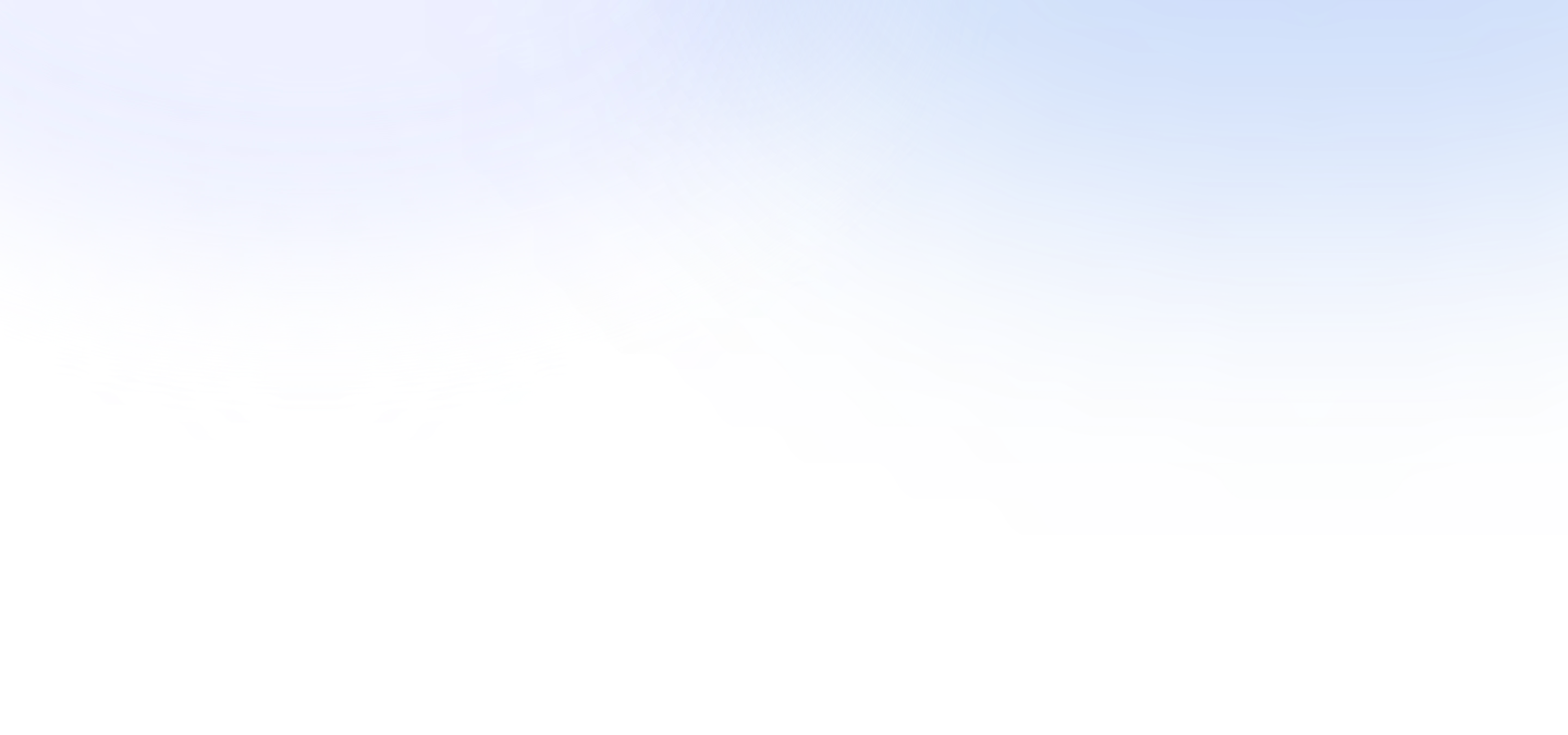

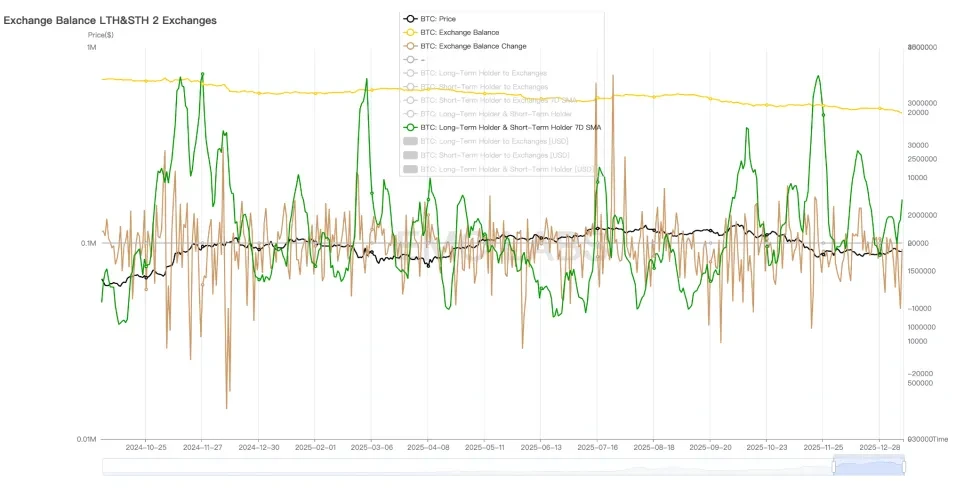

Long-term hand-sales statistics of central exchanges (days)

This risk preference has led to a lack of sustainability in the downside of sales, which is now downscaled. The continued sale of long-hand groups remains the greatest threat to the encryption market in the medium term。

Long-held warehouse change statistics (days)

LAST WEEK, THE SUSTAINED REDUCTION OF THE LONG-HAND WAS REDUCED, BUT IT CONTINUED, WHICH ALSO TURNED THE BTC REBOUND INTO A DECLINE AFTER $94,000。

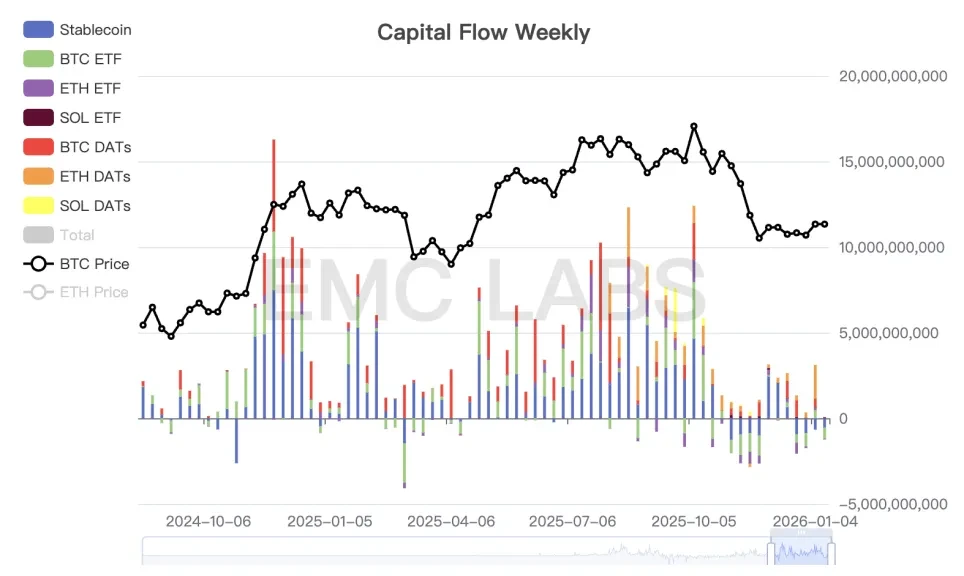

THIS IS ALSO CONFIRMED AT THE FINANCIAL LEVEL. THE LARGEST INFLOW OCCURRED ON 5 JANUARY AND CONTINUED OUTFLOWS SINCE THEN, RESULTING IN NET OUTFLOWS RECORDED THROUGHOUT THE WEEK, OF WHICH THE BTC ETF WAS $647 MILLION AND THE STABILIZATION CURRENCY WAS $539 MILLION。

Encrypted market access statistics (weeks)

Last week at the Centralized Exchange, it was almost 25,000. The forces supporting the market continue to come from the “whalfish group”, which has continued to increase its holdings over the past week. However, this group is currently using a strategy of “negative action”, which is only low-level washing and does not create upward power。

Periodic indicators

According to eMerge Engineering, the EMC BTC Cycle Metrics indicator is 0 and enters the “lower line” (Gear City)。

About us

EMC Labs was created in April 2023 by encrypted asset investors and data scientists. Focusing on sector chain industry research and Cripto secondary market investment, with industry foresight, insight and data mining as core competitiveness, is committed to engaging in dynamic sector chain industries through research and investment, and to promoting block chains and encrypted assets for human well-being。

read more at https://www.emc.fund