HONG KONG RWA REGULATORY PRACTICE AND REPRESENTATION PROJECT

THIS SECTION WILL ELABORATE ON HONG KONG ' S RWA REGULATORY PRACTICE AND REPRESENTATION PROJECT。

In early August 2025, Hong Kong's RWA-Stabilized Currency Race was at its peak of almost five years. At that moment, there was an unrepeated passion throughout the city in 2017-2018: traditional financial institution executives, AI entrepreneurs, and even industrial capital owners came to Hong Kong to look for a Web3 integration path, and food and hotel halls were full of discussions about dollar-based national debt, cash management tools, and stabilization currency legislation. A Wall Street banker, who had just moved from New York to Hong Kong, had said that Hong Kong had replaced New York as the hottest block-chain city in the world, with a crypto topic density and participation。

However, just over two months later, market temperatures fell sharply. There are clear signs of a tightening of the Mainland policy of regulating the arrival of financial institutions and assets in the mainland, the suspension or suspension of many of the in situ physical asset monetization projects on the string, and a sharp drop of 70 to 90 per cent in transactions on the RWA platform in part of the Chinese background. The RWA heat of Hong Kong, once regarded as “global number one”, appears to have slid into the middle of the summer, raising the market's skepticism about the centrality of Hong Kong International Web3. On 28 November 2025, the People's Bank of China took the lead in organizing a “meeting on coordination mechanisms to combat virtual currency trading” in 13 national departments, including the Central Finance Office, the National Development and Reform Commission and the Ministry of Justice. For the first time, stable currencies were included in virtual currency regulation, making it clear that virtual currency-related operations were illegal financial activities, stressing that they were not reimbursable and could not be used as money in circulation。

THE TIGHTENING OF REGULATION ON THE MAINLAND, ALTHOUGH IT ALSO AFFECTED MEDIUM-SIZED CLIENTS TO SOME EXTENT IN THE SHORT TERM, LIMITED CAPITAL OUTFLOWS FROM THE MAINLAND AND THE SUSPENSION OF RWA OPERATIONS IN HONG KONG BY SOME MAINLAND AGENCIES. HOWEVER, HONG KONG HAS A SPECIAL SYSTEM OF TWO SYSTEMS AND AN INDEPENDENT REGULATORY FRAMEWORK, WHICH IS NOT THEORETICALLY INFLUENCED BY CONTINENTAL POLICIES. THIS IS NOT A FUNDAMENTAL SHIFT IN HONG KONG’S RWA POLICY, BUT IS YET ANOTHER MANIFESTATION OF HONG KONG’S “HIGH-TEMPERATURE-STRUCTURAL REPOSITIONING” CYCLE, WHICH HAS BEEN REPEATED IN THE LAST TWO YEARS. IN 2023-2025, THREE STAGES OF EVOLUTION CAN BE CLEARLY OUTLINED:

- 2023 - 2024 H1: REGULATE THE OPENING OF GATES AND THE SANDBOX TEST PERIOD

HKMA has launched Project Ensemble, SFC has successively approved multiple monetized currency markets ETF and bond funds, and local licensed platforms such as HashKey and OSL have been granted a virtual VA licence extension, and Hong Kong has formally established a “regulated RWA test field” location。

- JULY 2024 H2-2025: BREAKOUT GROWTH PERIOD OF INTERNAL AND EXTERNAL RESONANCE

The passage of the US GENIUS Stabilisation Currency Act, the start of the Fed interest rate reduction cycle, and the clear position of the Trump government's pro-crypto, together with the publication of the Hong Kong Local Stabilisation Currency Legislative Advisory Paper, have triggered an accelerated global influx of funds and projects. In a short period of months, AUM surged from tens of millions of dollars to billions of dollars, with Hong Kong briefly becoming the fastest-growing market for RWA worldwide。

- Since August 2025: limited participation and risk isolation period

LOCAL REGULATION HAS TAKEN A MORE CAUTIOUS APPROACH TO CROSS-BORDER ASSET MONETIZATION, CLEARLY LIMITING THE DEEP INVOLVEMENT OF CONTINENTAL INSTITUTIONS AND INDIVIDUALS IN HONG KONG ' S RWA ECOLOGY AND OBJECTIVELY CUTTING OFF THE MOST IMPORTANT SOURCES OF INCREMENTAL FUNDS AND ASSETS PREVIOUSLY. HONG KONG'S LOCAL AND INTERNATIONAL CAPITAL CONTINUES TO BE ALLOWED TO PARTICIPATE FULLY, BUT THE MOMENTUM FOR GROWTH HAS SHIFTED FROM A “OVER-CHAIN” TO “LOCAL + GLOBAL COMPLIANCE FUNDS TO UNITED STATES-LED ASSETS”。

The bottom logic of cyclical cooling is the dynamic balance between “participating in the new global digital economy” and “preventing systemic financial risk”. The role of Hong Kong has been re-established as a full interface with the United States-led block-chained economic network, limited to local resources, while building firewalls to block risk transfer to the interior。

This means that the RWA market in Hong Kong is not going into recession, but rather into a clearer and more sustainable third phase: a shift from the former “wild growth” to a new pattern of “compulsory dominance, DeFi access, and global finance versus assets in the cosmopolitan chain”. Net-chain, high-transparent, low-risk cash management categories RWA (money market funds, national debt coins) will continue to grow at a high rate, while the physical RWAization path, which is highly dependent on assets and funds in the interior, will be significantly reduced。

For practitioners, the short-term pain of repeated policies is inevitable, but the space for compliance remains sufficient. In particular, US regulation of DeFi’s short-lived tolerance window, which creates a rare super-advanced advantage of the chain of services that can be legally provided by Hong Kong’s licensed platforms, provides a valuable strategic runway for the next step in moving deep-farming chains, structured products and cross-chain asset allocation within a regulated framework。

THE STORY OF HONG KONG RWA IS FAR FROM OVER, JUST FROM THE LOUD CROWDS TO THE COOLER AND MORE PROFESSIONAL PERIODS OF DEEP CULTIVATION. THIS PAPER WILL FURTHER ELABORATE ON THE RWA MARKET IN HONG KONG AND RELATED REPRESENTATIONAL PROJECTS。

HONG KONG RWA MARKET PATTERN

The RWA (Real World Assets, Real World Assets) market in Hong Kong was established as the most regulatoryly mature ecological hub in Asia in 2025 as a frontier for the integration of global block chains with traditional finance. The market, driven by the Hong Kong Financial Authority (HKMA) and the Securities and Futures Supervisory Commission (SFC), is focused on monetized currency market instruments, government bonds, green bonds and emerging physical assets (e.g. income from charging stakes and international shipping rents) through the Project Ensemble Sandbox project and the Digital Asset Policy 2.0 framework. The overall pattern is characterized by “agency ownership, compliance ahead, and deFi progressive”: moving from pilot distribution in 2024 to a structured infrastructure in 2025, emphasizing cross-chain settlements, stable currency integration and global liquidity. Hong Kong ' s RWA ecology has been transformed from a "finance window " to an "innovation platform " , which is linked to a deep United States-led chain of networks, while building a risk wall to guard against cross-border transmission。

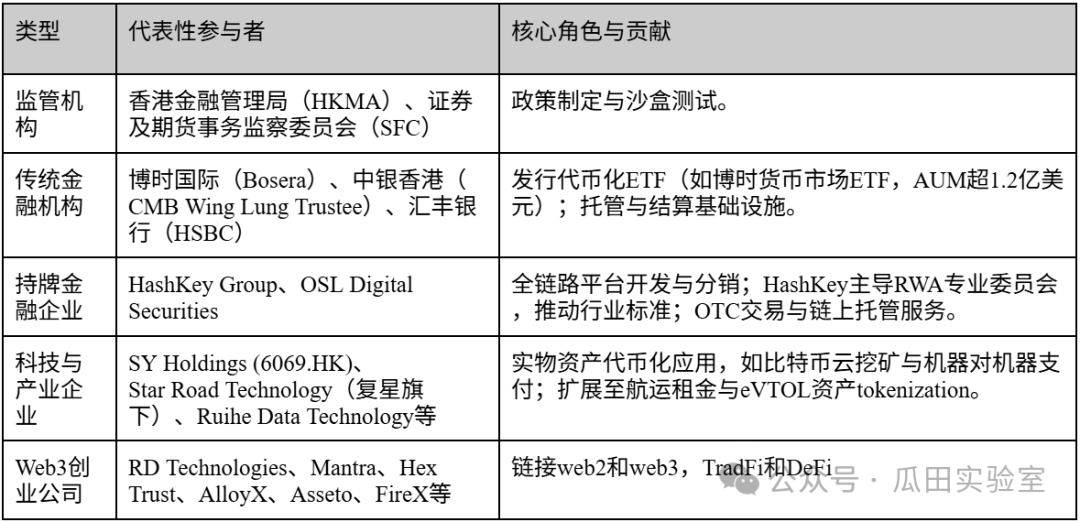

Type of participant: Institutional capital dominance, science and technology enterprises coexisting with start-ups

The RWA market participants in Hong Kong are highly hierarchical, dominated by institutional capital, supported by the initial creation of indigenous science and technology enterprises and the new Web3 to create closed ecology. The following table summarizes the main types (based on entities active in 2025):

AS CAN BE SEEN, THE HONG KONG MARKET IS STILL DOMINATED, ACCOUNTING FOR ABOUT 70 PER CENT OF THE TOTAL, LEADING TO HIGH-THRESHOLD PRODUCT DISTRIBUTION; BUSINESS AND START-UPS FILL THE TECHNOLOGY AND APPLICATION GAP AND BENEFIT FROM THE EXPANSION OF THE SFC'S VA LICENSE PLATE。

Overall size and growth

In 2025, AUM jumped from tens of millions of dollars at the beginning of the year to billions of dollars within the framework of the global $26.59B - $35.8B chain of TVL. Growth has been driven by the policy multiplier effect - the 2025 Governance Report called for RWA investment in infrastructure, and the stabilization currency regulation will come into effect in 2026, with a projected 90 per cent reduction in cross-border payment costs and a 10-second settlement deadline. The annualized growth rate was over 200 per cent, TVL and 58 times the expansion over the course of the year, but high compliance costs (over $8.2 million for single product issuance) limited retail penetration, with institutional inflows accounting for over 80 per cent。

Assessment of future development potential

Hong Kong, with its vast potential, is projected to be the top three (after the United States and Singapore) market size of trillions of dollars in 2025-2030. The advantage is to regulate the iterative speed of sandboxes in line with international standards: the SFC is about to open up global order book sharing to increase liquidity; the Ensemble project will build a tokenized deposit clearing system that will radiation emerging trade chains such as Brazil/Thailand. The integration of the DeFi tolerance window with the AI+ block chain (e.g., shipping rent tokenization, unlocking $200 billion market) will drive the diversity scene, with the creation of an ecological project expected to add 50+. Challenges include cost barriers and the isolation of capital from the Mainland, but this strengthens Hong Kong's “global neutrality hub” position: to attract European and American institutions to allocate US debt / MMFs, while local firms cultivate Asian physical assets. Overall, Hong Kong RWA is moving from a “heat-driven” to a “sustainable growth” where policy continuity and infrastructure maturity are key。

HONG KONG RWA RELATED PLATFORM

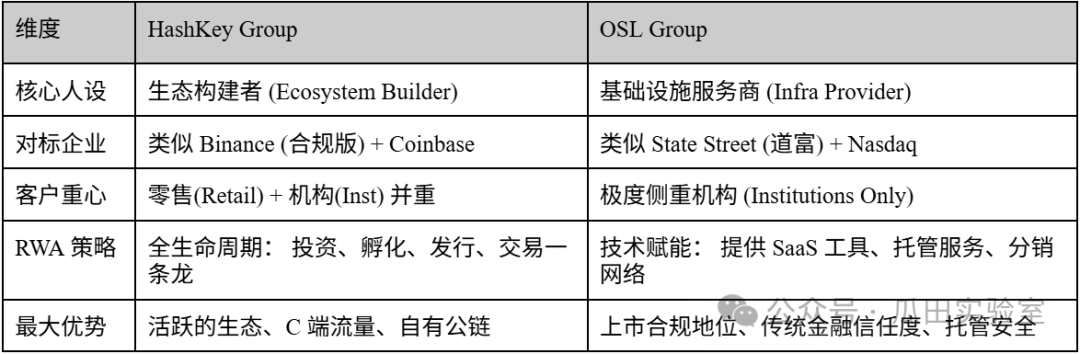

HashKey Group - a "all-in-house" building block of a compliant ecology

In Hong Kong's ambition to become a global Web3 centre, HashKey Group is undoubtedly the most representative “flagship”-class entity at present. As Asia’s leading end-to-end digital asset financial services group, HashKey is not only a pioneer in Hong Kong’s compliance trading market, but also a builder of RWA’s key infrastructure for asset distribution and trading. Its strategic configuration, ranging from bottom-up block chain technology to upper-level asset management and transactions, forms a complete compliance closed loop。

HashKey Group was founded in 2018, with a headquarters in Hong Kong, with a deep link to the Wanxiang Block Chain Labs. HashKey set the path of embracing regulation at the outset of the introduction of the Virtual Asset Trading Platform licensing system at the Hong Kong Securities Commission (SFC)。

In August 2023, HashKey Exchange became the first Hong Kong exchange to receive upgrades to categories 1 (securities transactions) and 7 ( provision of automated trading services) and was authorized to provide services to retail investors. This milestone not only established its legitimate monopoly advantage in the Hong Kong market (one of the two oligarchs), but also provided an effective channel for future secondary market flows of RWA-compliant products (e.g. STO, issue of securities-type tokens)。

On 1 December 2025, HashKey Group heard from Hong Kong's police station and is about to land on Hong Kong's main board, hoping to become the first share of Hong Kong's licensed virtual assets. With regard to the analysis of Hashkey's book of admissions and listing prospects, there are a number of industry experts who consider the listing of Hashkey to be a landmark event that will help Hong Kong to compete for pricing and voice rights in the area of Web3 globally (particularly vis-à-vis Singapore and the United States) and establish Hong Kong's status as a “compatible digital asset centre”。

HashKey's architecture is not a single exchange model, but rather an ecosystem that serves the entire life cycle of RWA:

- HashKey Exchange (trade level): HONG KONG ' S LARGEST LICENSED VIRTUAL ASSET EXCHANGE PROVIDES ACCESS TO FRENCH CURRENCY (HONG KONG DOLLAR/UNITED STATES DOLLAR). FOR RWA, THIS IS THE END OF THE LIQUIDITY OF FUTURE ASSET MONETIZATION。

- HashKey Tokenism: is the core engine of its RWA operation. The unit focuses on assisting institutions in the monetization of physical assets (e.g. bonds, real estate, works of art, etc.) to provide a one-stop STO solution from advice, technology to legal compliance。

- Hashkey Capital (asset management): the top global block chain investment agency, with asset management (AUM) of over $1 billion. Its role in the RWA area is more evident in the support of the financial sector and the construction of products (e.g. ETF)。

- Hashkey Cloud (infrastructure level): provides nodal validation and technical support at the bottom of the block chain to ensure the security and stability of the chain of assets。

In the RWA market in Hong Kong, the core competitiveness of HashKey is reflected in two dimensions of “compliance” and “ecological linkage”:

- Supervising the moat:At the heart of & nbsp; RWA is the mapping of supervised sub-line assets into chains. HashKey has a full compliance license and is able to legally process a “security” token, a threshold that most non-licensed DeFi platforms cannot cross。

- “Medium scale” level ecological capacity:& nbsp; has access to the Tokenisation, Capital and Exchange. For example, a real estate project may be denominated by HashKey Tokenisation, with the participation of HashKey Capital in early subscriptions, and eventually traded in HashKey Exchange。

- institutional connector: HashKey has established cooperation with traditional financial institutions, such as the Banque du Monde (ZA Bank) and the Transport Bank (Hong Kong), to resolve the most critical problems of “access money” and monetary settlement of RWA。

HashKey's practice in the RWA area is mainly in the direction of “traditional financial assets uplink” and “compliance issuance”. Here is a summary of their typical cases:

HashKey Group is not just an exchange but an operating system for the RWA market in Hong Kong. HashKey is transforming “assets monetization” from concept to enforceable financial operations through the possession of scarce compliance licences and the construction of a whole-house technical facility. For any agency that wishes to issue or invest RWA in Hong Kong, HashKey is a partner that cannot be bypassed。

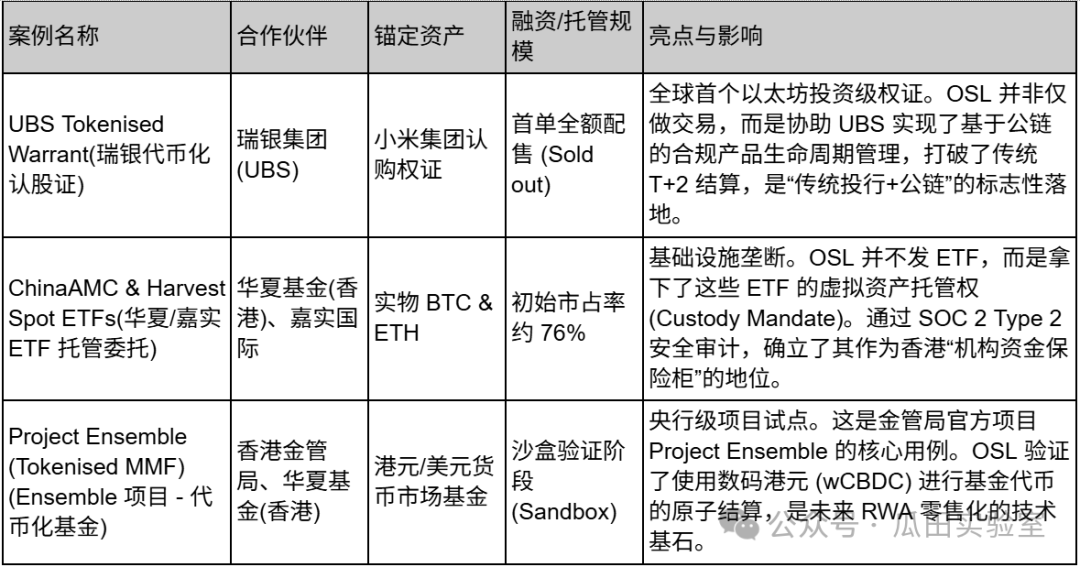

OSL Exchange — “digital arms dealer” and infrastructure expert in traditional finance

In the chess game of RWA in Hong Kong, if HashKey is a “flagship” that is ahead of and builds an ecological integrity, OSL Group (formerly BC Group for Technology, 863.HK) is an “arms dealer” who provides technology to traditional financial institutions behind deep plows。

OSL , the only listed company in Hong Kong that focuses on digital assets; financial transparency and auditing standards for listed companies. This has made OSL it has become the preferred “safe passage” for traditional banks, sovereign funds entering the RWA market, which are extremely averse to risk。

Unlike HashKey, which actively expands retail users and constructs public chain ecology, the strategic focus of OSL is on institutional business. It is not designed to “build an exchange” but to “help banks build their products”:

- A unique “listed company” moat:

- At the heart of RWA lies the adoption of the traditional financial (TradFi) compliance review. For large banks, compliance costs in cooperation with a listed company (Public Company) are much lower than for private enterprises. OSL's financial statements are audited in four major areas, and this “institutional trust” is its greatest card in the B-end market。

- Technical output (SaaS Model):

- Instead of insisting that all assets be traded on OSL platforms, OSL Tokenworks is willing to export technology to help banks build their own monetization platforms. This is a “sell shovel” strategy - whoever sends RWA, with a bottom-up technology or a mobility pool, OSL is profitable。

- Monopolistic status in the field of trusteeship:

- In Hong Kong's first edition of the Bitcoin/Etherdorf cash ETF, both Harvest and ChinaAMC chose OSL as virtual asset trustees. This means that over half of the bottom assets in the ETF market in Hong Kong are under OSL control. In the case of RWA, “whoever has custody, he has control of the assets”。

In the RWA industrial chain, OSL defines itself as a sophisticated conduit linking traditional assets to the Web3 world:

- RWA Structure and Distribution (Structurer & Distributer):

- Using its status as a coupon holder, OSL is good at dealing with complex financial product structure. It is not just a simple “asset-up”, but focuses on the monetization of investment-level Glade products, such as bank notes, structural products, etc。

- Cross-border compliance mobility network:

- OSL works in depth with Zodia Markets, under the banner of Scum Chartered Bank, and with the Japanese financial giant. On RWA liquidity, OSL follows the Dark Pool and off-site trading (OTC) routes, rather than the retail order book model。

OSL cases are usually not limited to Hong Kong, but have strong international demonstration effects, and partners are the top TradFi giants whose B2B characteristics generally do not disclose the scale of financing:

In order to understand the difference more intuitively, a comparative table for HashKey vs. OSL was especially summarized:

If HashKey is building a rich “Web3 Business City” in Hong Kong, OSL is like the chief engineer in charge of the city's underground network, treasury security and power supply. In the RWA market, OSL does not seek the largest volume of “issuance”, but is committed to becoming the safest “storage” and the most compliant “channel” for all RWA assets。

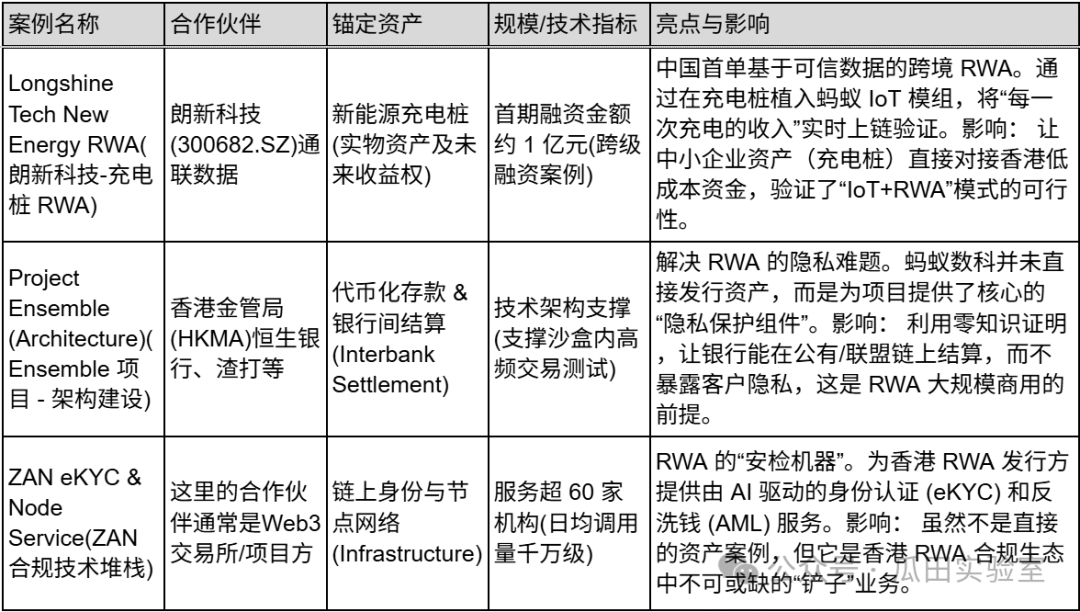

Ant Digital - a "credible bridge" uplink of physical assets

In Hong Kong's RWA, the Ant Numbers Section (and its Web3 brand ZAN) represents a fallout from Internet giants. Unlike financial institutions, which focus on “licensing” and “trading”, the core competitiveness of ant count is to address the bottom point of the RWA: how do we prove that Token on the chain really corresponds to the physical assets under the chain

The strategic path of the ant count section is very clear: using the high performance technology of the AntChain, which has been growing deep in the country for many years, combined with the Transted Iot, an international window in Hong Kong, which provides technical standards and certification services for the global RWA project to digitize assets。

The ants section in the RWA market in Hong Kong does not exist as a “place of trade” but is located as a Web3 technical service provider. Its business logic can be summarized as “one cloud at both ends”:

- Asset Side: & nbsp;Real-time data collection and direct chaining are done through the installation of physical equipment such as photovoltaic panels, chargers, engineering machinery, etc., in the Trusted Modeles. This has led RWA to move from “subject-based” to “asset-based” (confidence in real-time cash flows generated by equipment)。

- Capital Side: & nbsp;COMPLIANCE WITH FINANCIAL ENTRY AND EXIT IS ENSURED THROUGH THE ZAN BRAND TO PROVIDE KYC/KYT (CUSTOMER IDENTIFICATION), SMART CONTRACT AUDIT AND NODAL SERVICES TO INSTITUTIONAL INVESTORS。

- privacy protection: It is a rare manufacturer of zero-knowledge certification (ZKP) technology at the Hong Kong Monetary Authority Project Ensemble, which resolves the demise of a bank “to verify transactions and not disclose business secrets” when it settles assets in the public chain。

In the case of HashKey and OSL dealing with “securitized assets” (e.g. bonds, funds), the Ant Numbers Section is extremely good at dealing with “non-standard physical assets”:

- source credible: & nbsp;THE TRADITIONAL RWA RELIES ON AUDITORS TO TAKE STOCK OF THE WAREHOUSE, WHILE ANTS ARE ABLE TO LINK THE OPERATING DATA (POWER GENERATION, MILEAGE) OF NEW ENERGY VEHICLES, BATTERIES AND EVEN BIOLOGICAL ASSETS (E.G. CATTLE) IN REAL TIME BY IMPLANTING CHIPS。

- large-scale co-processing: & nbsp;The technical gene of the “two-xity” level of the payment, the chain of blocks in the ant count section, can support and chain up billion-grade asset data, which most public chains cannot reach。

- ZAN BRAND INTERNATIONALIZATION:& nbsp; 2024-2025, ZAN rapidly emerged in Hong Kong as a key intermediate platform connecting Web2 developers and Web3 the world, especially in the area of Compliance Technology。

The cases of the Ant Numbers Section are mainly described as “substantive economic chains” and “interbank settlement structures”。

If HashKey is a poach, a platform for buying and selling RWA goods; OSL is a “bank” that provides the safest warehouse for the agency to keep the RWA assets, then the ant count section is a “smart factory + mass inspector” that goes deep into the production chain (charging stakes, batteries), puts “qualified labels” on each asset, and provides the technology to make these assets flow smoothly. The Ant Numbers Section in the RWA market in Hong Kong, based on data, is committed to becoming the “customs” and “translators” of physical world assets to the Web3 world。

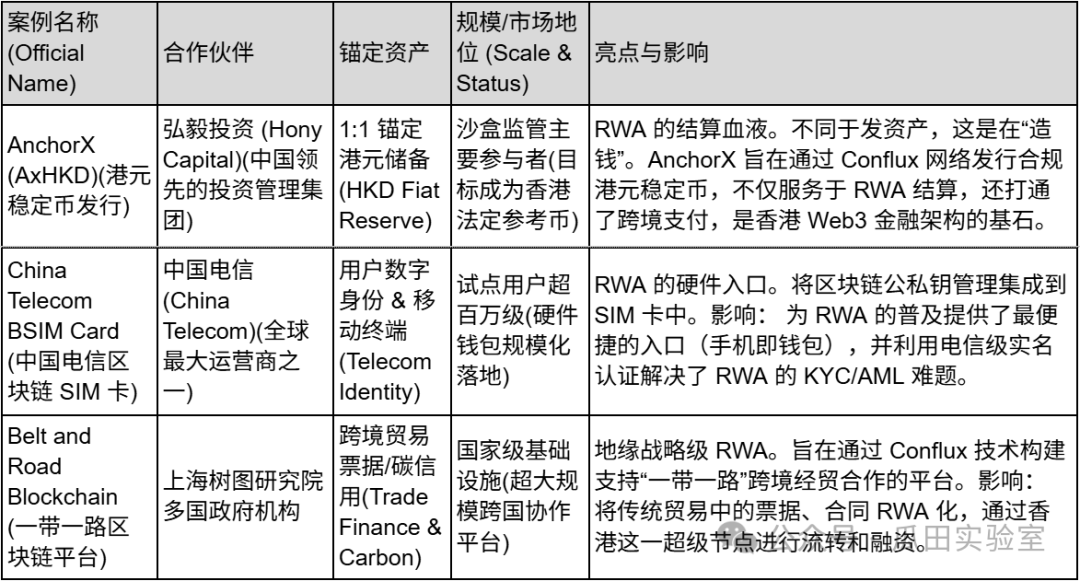

Conflux Network - a “compatibility chain” between Mainland and Hong Kong

In the RWA market in Hong Kong, the vast majority of platforms (e.g. HashKey, OSL) mainly address the issue of “how assets are traded locally in Hong Kong”, while Conflux addresses the question of “how assets in the interior come out of compliance” and “how are they settled in terms of what currency”。

As “the only public chain of compliance in China”, Conflux uses the background of its Shanghai Tree Map Block Chain Research Institute to bind the resources of China's national teams, such as telecommunications and initiatives along the way. In the Hong Kong market in 2025, Conflux was no longer just a technology chain, but rather a central distribution of the renminbi offshore/port stabilization currency。

The RWA strategy of Conflux is very different from that of others, avoiding crowded asset management tracks and focusing on the bottom of the infrastructure:

- RWA BLOOD (STABLE CURRENCY):& nbsp; Conflux Incubated and supported AnchorX (the main investor is Hirondelle ' s investment) for the issuance of compliant Hong Kong dollar stabilization (AxHKD). In RWA transactions, chaining of assets is the first step, but “what to buy” is the second step. Conflux is trying to make AxHKD the clearing currency for the RWA market in Hong Kong against USDT/USDC。

- PHYSICAL ENTRANCE (BSIM CARD):& nbsp; a BSIM card launched in cooperation with China Telecommunications, which directly implants block chain private keys into a mobile phone SIM card. For RWA, this means that future assets rights (e.g., you bought a monetized property on your mobile phone) can be tied to the real identity of the telecommunications operator, which solves the RWA’s most difficult “ID” problem。

- mainland-hong kong connector: Using its research and development centre (tree map) in Shanghai, Conflux is able to take on the needs of inland enterprises for access to the sea and provide technical means for the inland physical assets (e.g. photovoltaic, supply chain) to be properly mapped on Hong Kong ' s Conflux public chain for financing。

In the RWA track, Conflux's moat lies in its geopolitical advantage:

- “..interoperability after dissensitisation: Conflux has achieved a unique technical architecture that is consistent with the regulation of the interior (non-currency block chain technology applications) and enables to make a Tokenization transaction in Hong Kong through the cross-chain bridge. This makes it the most politically correct option for mainland companies to try RWA to go to sea。

- Payment and settlement closed ring:& nbsp; through the AnchorX project, Conflux is actually participating in the “sandbox supervision” of the Hong Kong Monetary Authority. When the Hong Kong dollar stabilizes the land, Conflux will move from a simple “road” to a financial network with a “passage fee” pricing power。

- High performance: RWA (especially HF bills or retail assets) requires extremely high TPS (trade volume per second). Conflux ' s tree map structure (Tree-Graph) is known to reach 300,000-6000 TPS, which is more advantageous in dealing with the high volume of traditional financial transactions than with the network of owners of the Taifung。

The Conflux case focused on “monetary infrastructure” and “national cooperation”。

Conflux Network is the only public-chain player in the RWA market in Hong Kong. It does not make money directly through transactional fees, but rather seeks to become a “digital Silk Road” linking China to global finance through the establishment of lower standards (Stabilization Currency, SIM Card Standards)。

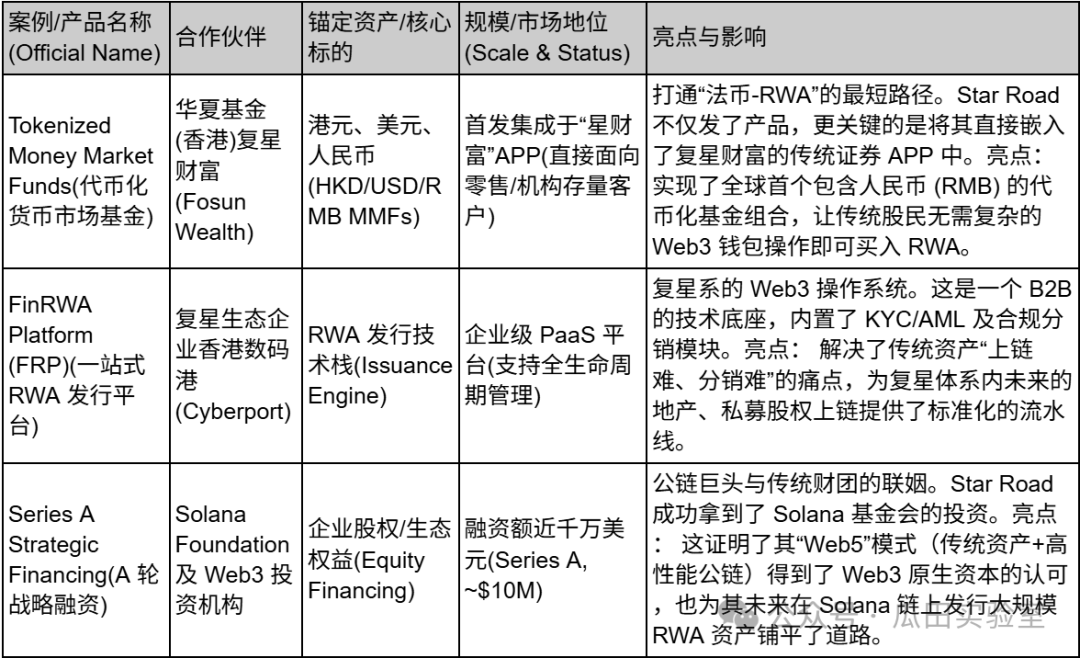

Star Road Technology - Customized First Class for Old Money to Web3

In Hong Kong's RWA market, Star Road Technology (Stellar Technologies, part of the overseas branding Finloop) is not the most vocal “subversive”, but it is likely to be the most solid “successor”。

Instead of looking at Star Road as an independent Web3 start-up company, it's going to look at it as a large, integrated private enterprise. A “official landing boat” from Fusun International to Digital Asset World. With Fosun Wealth hatching independently, Star Road itself was born with a clear corporate will: It is not committed to building a new financial order from scratch, but to bringing traditional finance to a world where large holdings and high net-value customers are smooth and compliant。

Star Road introduced a unique "Web5" concept at the strategic level. Unlike purely decentrized Web3 idealism, Star Road's Web5 strategy is more like a pragmatic compromise -- it seeks to integrate mature Web2 user experiences with the flow portal (the customer base of the resurgent wealth), and Web3 value interconnection techniques。

Under this narrative, Star Road built its core infrastructure, the FinRWA platform (FinRWA Platform, FRP). This is an enterprise-level RWA distribution engine, but it was designed not to serve anonymous chain hackers, but rather to serve institutions and high net worth individuals in a re-star system. It is like a sophisticated converter, with one end connected to the real estate, consumption, troupe and other real estate assets that have been cultivated for many years, and the other to the compliance digital asset distribution network. For Star Road, RWA is not an end in itself, but a means to activate the liquidity of the group ' s inventory assets。

Unlike other platforms interested in exploring high-risk, high-yield DeFi games, Star Road has chosen one of the most robust pathways:IMF tokenization。

With a deep alliance between the Wahsha Foundation (Hong Kong) and the parent company's recovery of wealth, Star Road launched a boxing product focused on the Hong Kong dollar, the United States dollar and the renminbi's monetized money market fund. This option is very strategic — the IMF is the most familiar and lowest-threshold pool of traditional investors. Star Road uses its technology to convert these funds, Token, to actually provide the safest ticket for the “old money” that looks forward to Crystal。

More importantly, Star Road has reached the RWA channel of the RMB. In the context of Hong Kong as an offshore currency centre, this capacity has enabled Star Road to accurately capture off-shore background capital that holds large amounts of offshore renminbi and seeks compliance to add value to the sea。

Star Road's business map isn't like an exchange, it's more like a family"Specific digital investment bank"I don't know. The case shows the complete closure from “bottom technology” to “assets issuance” to “ecological capital”:

Star Road Technology represents the understanding and transformation of Web3 by the traditional financial elite: rather than radical decentrization, it seeks extreme compliance, security and experience. Star Road is the most uncompromising and smoothest entry point for institutions and high net value populations that wish to maintain their traditional financial services experience。

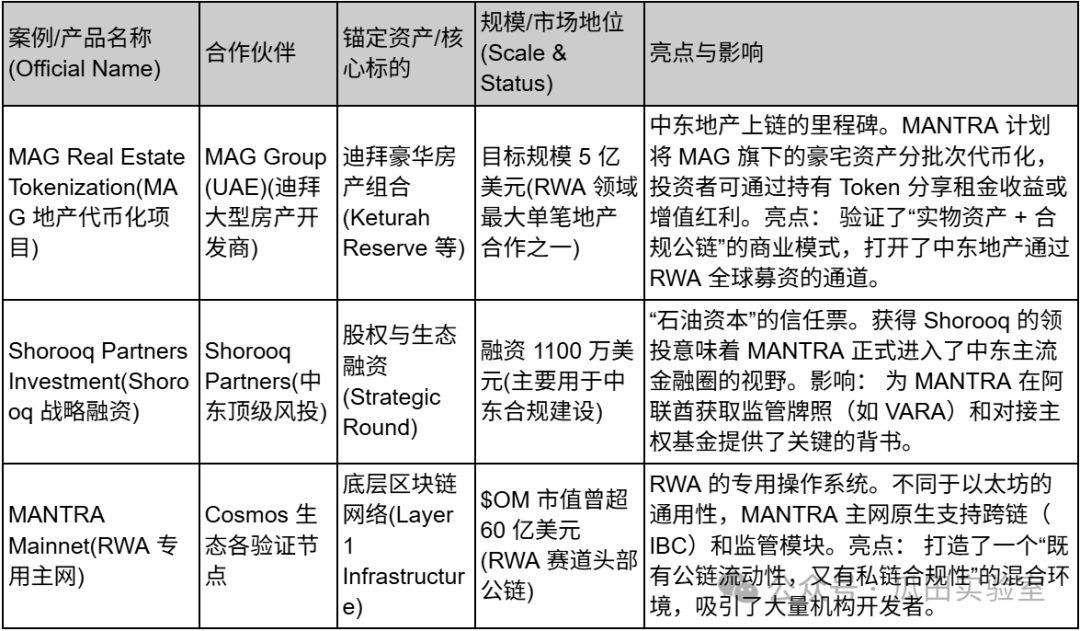

MANTRA — & nbsp; RWA “Conform Highway” linking the Middle East to Asia

IN THE ERA OF WAR STATES IN RWA, MANTRA REPRESENTS THE RISE OF THE INFRASTRUCTURE WING. IT DOES NOT SATISFY THE MERE ISSUANCE OF AN ASSET, BUT RATHER ATTEMPTS TO DEFINE THE BOTTOM STANDARD FOR RWA ASSETS OPERATING ALONG THE CHAIN。

AFTER SEVERAL YEARS OF TRANSFORMATION, MANTRA, THE PREDECESSOR OF MANTRA, EVOLVED INTO A RWA PUBLIC CHAIN FOCUSED ON REGULATORY COMPLIANCE. ITS STRATEGIC FOCUS IS UNIQUE – AVOIDING A COMPETITIVE AND HOT UNITED STATES MARKET AND NOT EVEN RELYING ENTIRELY ON HONG KONG, BUT RATHER ON THE UNITED ARAB EMIRATES (UAE), WHICH HAS BUILT A CORRIDOR LINKING CAPITAL IN THE MIDDLE EAST TO ASIAN LIQUIDITY, USING DUBAI’S EXTREMELY FRIENDLY VIRTUAL ASSET REGULATORY FRAMEWORK (VARA)。

AT THE STRATEGIC LEVEL, MANTRA ADDRESSED A CENTRAL PROBLEM: THE CONTRADICTION BETWEEN THE “UNLICENSED” OF THE PUBLIC CHAIN AND THE “STRONG REGULATION” OF FINANCE。

- Primary compliance: & nbsp;AMTRA Chain has built into the bottom of the protocol the identification (ID), KYC/AML modules and the compliance white list mechanism. This means that developers do not need to write complex compliance codes themselves and directly call the MANTRA module to issue real estate coins or bonds that meet regulatory requirements。

- “Oil capital” connecting the Middle East:& nbsp; MANTRA obtained the lead for the Middle East Top Windshow Shorooq Partners and established a deep collaboration with the Dubai Real Estate giant MAG. This brings not only finance, but also, and more importantly, access to the vast resources of real estate and sovereign wealth in the Middle East region, a unique advantage not available on other platforms that rely mainly on dollars or Hong Kong dollar assets。

- web incentives and currency economy: MANTRA has built a close economic closed ring through its buy-back and pledge mechanism for the original coin $OM. It uses token incentives to attract agency certifiers and asset distributors and attempts to use Web3 incentive models to pry up TradeFi assets。

At the asset end, MANTRA chooses the most heavy but also the sexiest track: Real Estate. Unlike public debt, RWA (which is also the strength of platforms such as Star Road), real estate, RWA, needs to deal with complex bottom-up powers and legal structures. MANTRA works directly with the Dubai developer MAG and plans to monetize $500 million of the luxury real estate portfolio. This is an ambitious approach — if it can turn Dubai's mansion into a chain-streamed Token, MANTRA has demonstrated its ability to deal with “non-standard, large, physical assets”, much deeper than the mere moat of national debt。

IN ADDITION, IN 2025, MANTRA LAUNCHED A LARGE-SCALE DOLLAR OM TOKEN BUY-BACK SCHEME (A COMMITMENT OF AT LEAST $25 MILLION), A “STOCK BUY-BACK” BEHAVIOUR SIMILAR TO THAT OF LISTED COMPANIES, WHICH GREATLY BOOSTS INSTITUTIONAL INVESTORS' CONFIDENCE IN THEIR CURRENCY ECONOMIC MODEL。

THE MANTRA BUSINESS LAYOUT FEATURES CLEARLY "MIDDLE EAST ASSETS + ASIAN TECHNOLOGY + GLOBAL COMPLIANCE":

ALTHOUGH MANTRA STARTED IN HONG KONG, IT HAS SHIFTED ITS FOCUS TO THE MIDDLE EAST IN LINE WITH ITS RWA COMPLIANCE STRATEGY. MANTRA REPRESENTS ANOTHER POSSIBILITY FOR THE RWA MARKET: NOT JUST TO MOVE ASSETS UP THE CHAIN, BUT TO CREATE A SPECIAL CHAIN FOR THEM. MANTRA IS CURRENTLY THE MOST REPRESENTATIVE INFRASTRUCTURE FOR INVESTORS WHO APPRECIATE THE PROSPECTS FOR CAPITAL RISE AND UPSWING IN THE MIDDLE EAST。

AlloyX - Link DeFi Liquidity and Entity Assets "Mixed Synth"

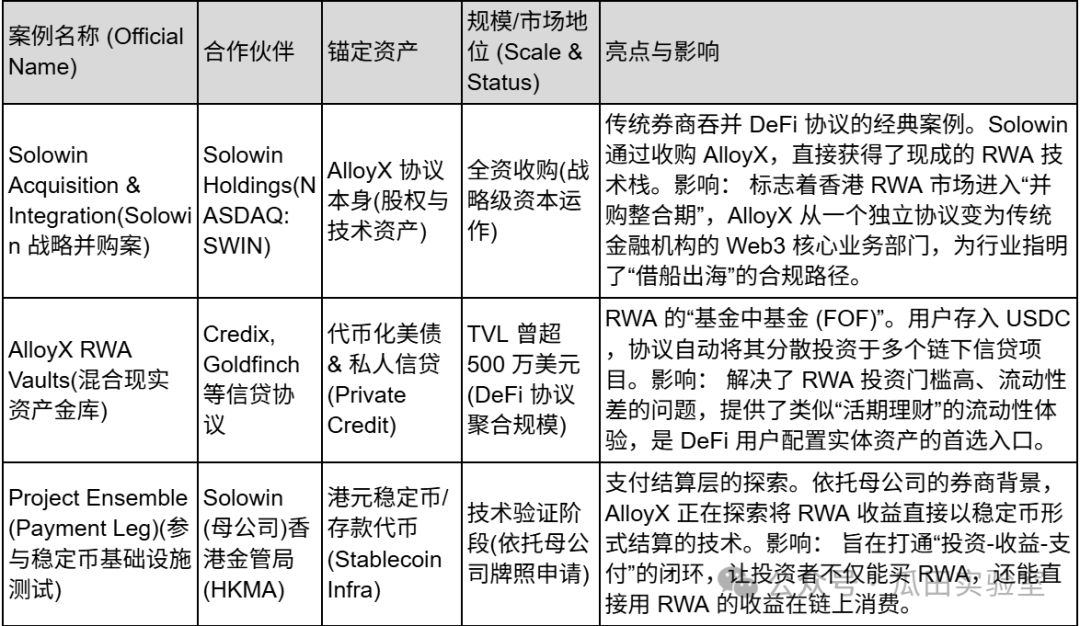

In the grand narrative of the RWA in Hong Kong, if HashKey and OSL build a “heavy asset” infrastructure similar to NASDAQ or bank vaults, AlloyX represents another agile force of the RWA market —”DeFi Primary polymerI'm sorry。

as a marketer from san francisco, united states of america, then listed in hong kong & nbsp;Solowin Holdings (NASDAQ:SWIN) AlloyX plays a unique role in Hong Kong's RWA mapCeDeFi (centre and decentrized finance) connectorThe role. It does not hold heavy physical assets directly, but rather through smart contract technology, which “packs” credit assets spread over different chains and agreements into highly liquid utensils directly to investors in the encrypted world。

AlloyX’s business logic is different from traditional exchanges. It's essentially a..& nbsp; RWA Asset Cohesion Protocol (Aggregator Protocol)I don't know。

In the early RWA markets, assets are fragmented: investors may want to buy United States debt on one platform, and private credit on another, with very high thresholds. AlloyX's appearance solved this pain. It has built a modular "Vault" system with access to assets of various upstream credit agreements, including Centrifuge, Goldfinch and Credix. By standardizing it into a single tokenized product, AlloyX allows users to easily deploy USDC and other stable currencies into the real world’s credit assets, as if they were depositing surplus treasures。

With the formal incorporation of Solowin Holdings in 2025, AlloyX completed the luxurious transition from the Pure DeFi Agreement to the Compulsive Financial Technology Flagship. Now AlloyX, more like Solowin, a traditional coupon dealer stretches to a toucher in the Web3 world, using Hong Kong's compliance license advantages, to distribute traditional securities, funds, etc. assets through AlloyX's technology pipeline to global investors in the form of Token, and achieves real reality."Assets secured in the traditional world, liquidity released in the block chain worldI'm sorry。

In the highly competitive Hong Kong market, AlloyX ' s moat is largely reflected in its unique shareholder background and combination of technical structures。

First of allThe endorsement and resource injection of listed companiesIt is its greatest differential advantage. AlloyX, a fully-owned subsidiary of Nasdaq listing company Solowin, jumped out of compliance difficulties with the regular DeFi project. It is able to design and distribute legally a monetized product of a securities nature using the Hong Kong Securities Commission (SFC) category 1, 4, 9 licensed resources held by its parent company. This “Facetop DeFi experience + backstage coupon-holders” model fits perfectly into the direction of CeDeFi regulation in Hong Kong。

Second, AlloyX has a very strong “asset portfolio” technical capability. Unlike a single asset issuer, AlloyX is good at combining different risk classes of RWA assets (e.g. low-risk dollar debt and high-risk trade finance) by algorithms to build a chain product similar to Structured Notes. This ability allows institutional investors to tailor their RWA portfolios to their own risk preferences and greatly enrich the profitability strategy of the RWA market。

AlloyX's business practices have focused on two dimensions: “Consolidation of assets” and “Conform issuance”, with the following being its most representative business cases:

Looking back at the development path of AlloyX, we can see clearly that it does not pursue large and complete platform traffic, but focuses on the finer operation of the asset end. Through Solowin's acquisition, AlloyX has in fact become the “technical engine” for the digital transformation of RWA by traditional financial institutions. For the market, AlloyX proves that RWA is not just a game of giants, but that technical agreements can also find a core ecological position within a compliance wall by placing them in depth。

Asseto - an agency-specific RWA "assets containment plant"

In Hong Kong’s RWA industrial chain, Assetto plays a key role in the “Originator” of assets. It is at the top of the chain and directly interfaces with the real economy。

As a flagship for strategic investment in HashKey Group RWA Infrastructure Project, Asseto has a very strong “renown”. It does not deal directly with the diaspora, but focuses on the most difficult “first kilometre” issue of RWA: how to “transform” a building or fund from a legal structure, technical standards and compliance process to a compliance Token

Assetto's business model is very vertical and high-barrier, mainly for the multibillion-dollar TradFi

- RWA Asset Gateway:& nbsp; Asseto provides a standardized set of technology that allows institutions to “strength up” assets such as cash management products, real estate and private credit. It provides not only smart contracts, but also, more importantly, “Legal Wrapper” services to ensure that Token on the chain has a real claim under Hong Kong law against the bottom assets。

- HashKey ecological "assets": & nbsp;As an investor in HashKey, Asseto is an important source of potential RWA assets for HashKey Exchange. Asseto is responsible for organizing assets (cleaning, securing, monetizing) under the chain and distributing them to secondary market investors via HashKey ' s compliance channel。

- The “appliance scenario” for the stabilization box: Asseto works closely with agencies that are applying for Hong Kong's stabilization licence plates to use RWA assets as reserve assets for the stabilization currency (Reserve Assets) and explores the high-end game of “currencyized national debt/cash to issue the stabilization currency”。

The core strength of Asseto in the Hong Kong market lies in the top-level resources generated by its shareholder structure:

- HashKey’s technology and channel support: HashKey not only paid but also opened HashKey Chain (L2C) to Assetto as the preferred distribution platform. This means that the assets issued by Assetto were born to own Hong Kong's largest compliance liquidity export。

- DL Holdings (1709.HK) has not only invested in Assetto, but also signed a strategic agreement to monetize the assets of its family offices (e.g. commercial property, fund share) through Assito. This addressed the most painful “asset rundown” of the RWA project, where Assetto entered with high-quality assets from listed companies。

Asseto's case is very “institutionally customized” and mainly revolves around real estate and cash management:

Asseto is an “assets alchemist” in the RWA market in Hong Kong. Instead of facing the diaspora directly, it hides behind the scenes, using sophisticated legal and technological models to smelt the large and heavy assets of traditional financial institutions into gold coins suitable for circulation in the Web3 world。

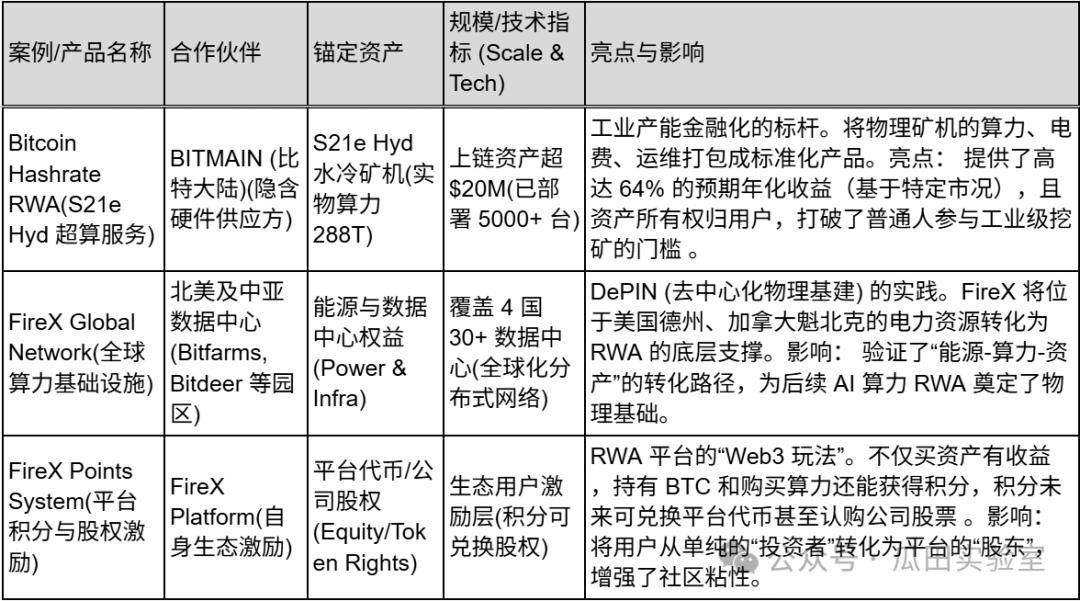

FireX - an "industrial level" RWA platform to release computing mobility

In the RWA market in Hong Kong, the vast majority of platforms deal with “paper assets” (e.g. bonds, equity), while FireX focuses on “production assets”。

FireX is an institutional-level RWA trading platform whose central narrative is “financializing the source (calculation) capacity of Bitcoin”. By working with top infrastructure providers such as Bitmain (Bitcontinent), it will host data centres and mining entities around the globe (United States, Canada, Kazakhstan, etc.) in tradable RWA tokens in chains. For investors, the purchase of FireX RWA products is essentially the purchase of a “future cash flow right” of a functioning supercomputer。

FireX’s business logic is very vertical, and it solves the mismatch between traditional mining “mobility” and Web3’s “lack of stable physical returns”:

- Calculus Assetization (Hashrate as an Assembly): & nbsp;FireX converts the “S21e Hyd miner” originally in the physical world and the resulting algorithm (288 TH/s) into a chain asset. This means that users do not need to build their own mines, do not need to maintain machines, and are able to hold their calculus and receive the proceeds of bitcoin excavations。

- global energy arbitrage network: FireX is not just a trading platform; behind it is a vast physical infrastructure network. It owns or cooperates with more than 30 data centres in Texas, Quebec, Canada, Ethiopia, etc. It's actually doing the global energy arbitrage -- looking for the cheapest electricity, turning it into bitcoin, and distributing the proceeds through RWA。

- diversification of asset configuration portal: In addition to the core bitcoin calculus, FireX 's vision includes global quality equities (e. g. NVDA, MSFT), Pre-IPO shares, and the RWAization of AI computing assets. It seeks to create an integrated asset allocation basket that “covers the digital and physical worlds”。

Unlike purely software protocols, FireX's moat is built on heavy hardware and ecological relationships:

- Verifiable entity size:& nbsp; FireX currently deploys over 5,000 overcalculable servers, manages more than 1,000 PH/s, and uplink assets worth over $20 million. This “visible” size of the entity provides RWA with the lowest credit endorsement - property rights are vested in the customer and the asset is actually running。

- Top ecological circle of friends: According to disclosure, FireX 's network of partners covers the mining giant BITMAIN (Bitcontinent), the mine pool Antpool and the head agencies Binance, Coinbase, Tether, etc. This capacity for resource integration, which runs through the chain of “mechanical production-mining-exchange-stable currency”, ensures stability and low-cost advantages in the supply of its assets (e.g., zero space, zero service charges)。

- high-yielding expected product design: & nbsp;Under the Bitcoin Cow cycle, FireX's calculus is showing very high yield elasticity. According to its S21e Hyd product, the ROI (investment return) may even be close to 100% on the optimistic assumption of a bitcoin price of $150,000. This is more attractive than the traditional national debt RWA。

FireX’s operations focus heavily on “calculative finance” and “global asset allocation”:

FireX is the "hard nuclear industry" on the RWA track. It emerges from a simple “new bottle” model of traditional financial assets, such as national debt, but provides the Web3 world with a base revenue layer supported by real machine sound and power consumption, by “securitizing” the original digital asset of Bitcoin。

BIPOLAR NARRATIVE: DEEP MATCH BETWEEN HONG KONG AND THE U.S. RWA MARKET

IF 2024 IS THE YEAR OF PROOF OF RWA, 2025 IS THE YEAR OF THE “BIPOLARIZATION” OF GLOBAL RWA MARKET PATTERNS. IN THE GLOBAL RWA MAP, THE UNITED STATES AND HONG KONG REPRESENT TWO DISTINCT BUT MIRRORED PATHS OF EVOLUTION。

The U.S. relied on its original DeFi innovation and dollar hegemony to become an RWA asset."Super factory”; AND HONG KONG HAS BECOME AN RWA ASSET BY VIRTUE OF ITS UNIQUE INSTITUTIONAL ADVANTAGES AND GEOCENTRIC POSITIONSuper Fine“and the distribution hub”。

regulatory philosophy: “law enforcement tolerance” vs. “sand box access”

America: Bottom-up jungle law

THE RWA MARKET IN THE UNITED STATES HAS GROWN SAVAGELY IN THE CHAIN OF REGULATION. ALTHOUGH THE REGULATORY ENVIRONMENT HAS BEEN SOFTENED SINCE THE TRUMP GOVERNMENT CAME TO POWER IN 2025, ITS CORE LOGIC REMAINS THAT:Law enforcement by Enforcement"and 'DeFi PriorityThe game。

- characteristics: The United States projects (e.g. Ondo, Centrifuge) started in the form of DAOs or decentralised agreements, seeking scale and technological innovation before circumventing the SEC securities recognition through complex legal frameworks (e.g. SPV offshoring)。

- advantages: & nbsp;Innovation is fast enough to achieve a portfolio of assets through smart contracts without license approval, and easy to produce BlackRock BuIDL, a phenomenal product of great scale。

- Disadvantage:& nbsp; The law is very grey and faces very high compliance risks when it involves cross-border distribution or non-qualified investors (Retail)。

Hong Kong: top-down design

Hong Kong is on the opposite path -Licensed (Licensing Regime)I'm sorry. From HashKey to Star Road (StarTech) cards 1, 4, 9 held by the planetary wealth, every step of the RWA in Hong Kong is within the visual scope of SFC and HKMA。

- Characteristics: "No license, no RWA". All items (e.g. OSL, HashKey) must be operated within the framework of Project Ensemble Sandbox or existing securities. Supervisors are not only referees, but also “product managers” (e.g. directing the design of tokenized deposits)。

- Strengths: very certain. once the product has been approved (e.g., waqf ' s monetization product), it can be legally transferred to the banking system and to bulk funds, with the endorsement of traditional financial institutions。

- disadvantage: & nbsp;Access thresholds and compliance costs are extremely high (over $0.8 million for individual projects), inhibiting grass-roots innovation and leading to market participants being mostly “hot” or “corporate”。

Market structure: the “fundamental DeFi” vs. “traditional consortium”

United States: DeFi Home of Native Capital

THE U.S. RWA MARKET STRUCTURE IS:DeFi Fit DownI'm sorry. The main sources of funding are USDC/USDT giant whales, DAO Treasury and encrypted hedge funds. Projectors (project) are usually technocrats who look down on cumbersome downline processes and work to convert everything (including national debt) into ERC-20 tokens, and then place it in Uniswap or Aave for collateral lending。

- typical portrait: An agreement like MakerDAO or Compund, buys a dollar debt through the RWA module to provide revenue support for a stable currency。

Hong Kong: Digital transformation of traditional consortia

HONG KONG'S RWA MARKET STRUCTURE IS:TradFi Fit Up Web3I'm sorry. The main sources of funding are the Family Office, the high net value population (HNWI) and the corporate treasury, which seeks to diversify its finances. The projecters often have deep industrial backgrounds (e.g., mineral computing resources behind FireX, re-star capital behind Star Road, real estate funds behind Asseto)。

- Typical portrait:The “Web5” strategy proposed by & nbsp; Star Road Technology is most typical - servicing stock of Web2 clients using Web3 technology. Hong Kong RWA is not about creating new assets, but about making the old money feel new and safe。

assets and project spectra: “standardized national debt” vs. “non-standard structured assets”

United States: unilateral hegemony over United States debt

THE U.S. RWA MARKET HAS ABOUT 80% OF THE TVL CONCENTRATED ON'Currencyization of good debtsI'm sorry. It's the most standard, the most mobile, and the easiest to accept under the DeFi agreement. Most of the RWA projects in the United States are settled at volume rates, volume T+0。

Hong Kong: Experimental field for multiple assets

"Constrainted by the size of the market, Hong Kong is unable to counterbalance with the United States on the pure American debt track, and has therefore moved towards "Variance"and 'PhysicalI'm sorry。

- RWA:The FireX packaged bitcoin computing and energy into RWA, an innovation unique to Hong Kong's “hard nuclear industry”, taking advantage of Asia's advantages in the global mining supply chain。

- Property and alternative assets:& nbsp; Mantra (deep in Asia although based in Dubai) and Assetto focus on off-the-shelf assets such as real estate, private fundraising, etc. Hong Kong is better placed to deal with complex downline rights (e.g., re-galactic assets handled by Star Road)。

- Infrastructureization: OSL and HashKey are not just assets, but the whole package of “Exchange+Customs+SaaS”, which reflects the genes of Hong Kong as a service provider for financial centres。

RWA RECOMMENDATION FOR MAINLAND ASSETS AND BUSINESS VISITS

GIVEN THE RECENT ADDITION OF LAYERS OF REGULATION, FOR ENTERPRISES WITH A CONTINENTAL BACKGROUND (SHAREHOLDERS, TEAMS, OPERATING ENTITIES), THE WINDOW PERIOD FOR ISSUING RWA THROUGH THE CONTINENTAL ASSETS/TEAM + HONG KONG SHELL MODEL HAS LARGELY BEEN CLOSED. THIS IS NOT JUST AN INCREASE IN COMPLIANCE DIFFICULTIES, BUT RATHER A SHIFT IN NATURE FROM A “GREY ZONE” TO A “HIGH RISK OF TORTURE”。

ON 28 NOVEMBER 2025, AT A SECTORAL MEETING OF CENTRAL BANKS AND OTHERS, IT WAS MADE CLEAR THAT THE STABLE CURRENCY WAS A VIRTUAL CURRENCY THAT WAS NOT LEGAL AND THAT THE OPERATIONS INVOLVED WERE ILLEGAL FINANCIAL ACTIVITIES. THIS BASICALLY CUT THE CORE OF THE RWA PAYMENT SETTLEMENT LEG. RWA PROCEEDS ARE USUALLY SETTLED IN A STABLE CURRENCY (USDT/USDC), WHICH IS CHARACTERIZED AS ILLEGAL. ON DECEMBER 05, 2025, THE RISK TIPS OF THE MAJOR INDUSTRY ASSOCIATIONS INDICATED THAT RWA, WHICH IS A DISGUISED CURRENCY, FOR THE FIRST TIME EXPLICITLY CLASSIFIED RWA INVESTMENT FINANCING AS ILLEGAL AND ILLEGAL PUBLIC FINANCING。

IN THIS POLICY ENVIRONMENT, MAINLAND COMPANIES ARE FACED WITH THREE DIMENSIONS OF DISRUPTION WHEN THEY GO TO HONG KONG TO ISSUE RWA:

LEGALLY REGULATED “LONG ARM” EXTENSION (PENETRATING REGULATION)

IN THE PAST, THE OPERATING MODEL WAS THE ESTABLISHMENT OF SPV (SPECIAL PURPOSE CORPORATION) IN HONG KONG, WITH MAINLAND PARENT COMPANIES ACTING ONLY AS TECHNICAL SUPPORT OR CONSULTANTS. THE WALL HAS NOW BECOME INEFFECTIVE。

- Subject matter: even if the issuer is in hong kong, if the person, manager or technical team is on the mainland, they are considered to be “cooperative with illegal financial activity” under the new regulations。

- help with risk: & nbsp;THE DECEMBER POLICY PLACED SPECIAL EMPHASIS ON WHOLE INDUSTRY CHAIN STRIKES. THE PROVISION OF TECHNOLOGY DEVELOPMENT, MARKETING DIVERSION, SETTLEMENT PAYMENTS, AND EVEN MUNICIPAL SERVICES TO ENTITIES (AND INDIVIDUALS) ON THE MAINLAND FOR RWA PROJECTS ABROAD MAY CONSTITUTE OFFENCES UNDER THE CRIMINAL CODE AGAINST THE OFFENCE OF ILLEGAL DEALING OR CYBERCRIME FOR THE PURPOSE OF FACILITATING INFORMATION (BREACH)。

B. “DEFAULT” OF THE ASSET END

HONG KONG RWA MARKETS ARE MOST EAGER FOR HIGH-QUALITY PHYSICAL ASSETS ON THE MAINLAND (E.G., THE RIGHT TO RETURN FROM PHOTOVOLTAIC PLANTS, THE RENTAL OF COMMERCIAL PROPERTY)。

- assets are locked out: & nbsp;SINCE RWA IS CHARACTERIZED AS AN ILLEGAL FINANCIAL ACTIVITY, THE BULKING OF ASSETS IN THE COUNTRY IS FINANCED BY WAY OF EXIT THROUGH THE RWA, WHICH IS SUSPECTED OF ILLEGAL FOREIGN EXCHANGE AND MONEY FLIGHT。

- power dilemma: The domestic law does not recognize the right of ownership of assets in the territory of the State through the chain of tokens. In the event of a breach of the project, an offshore investor would bring an action to enforce the assets with Token before the Continental Court, which would not support it (for violation of good and mandatory rules of public order)。

C. FINANCIAL “BLOCKING”

- flows of funds blocked: EVEN IF YOU RAISE USDT/USDC IN HONG KONG, THESE FUNDS CANNOT BE CHANNELLED BACK THROUGH FORMAL BANKING CHANNELS TO MAINLAND ENTITIES FOR USE IN THE REAL ECONOMY (BECAUSE BANKS REFUSE TO RECEIVE “VIRTUAL CURRENCY-RELATED OPERATIONS”)。

- Red marketing lines for mainland investors: marketing to Chinese citizens is strictly prohibited. If your RWA product description (PPM) has a Chinese version, or if your road show involves a continental IP, it will trigger the red line directly。

ACCORDING TO MARKET FEEDBACK, THE RWA MARKET IN HONG KONG HAS HAD A DRAMATIC REACTION SINCE 28 NOVEMBER. ABOUT 90 PER CENT OF THE RWA CONSULTANCY PROJECTS WITH A CONTINENTAL BACKGROUND HAVE BEEN SUSPENDED OR CANCELLED, AND THERE HAS BEEN A SIGNIFICANT DECLINE IN THE VALUE OF THE SHARES OF PORT LISTED COMPANIES (ESPECIALLY THOSE OF PARENT COMPANIES ON THE MAINLAND, SUCH AS METS, NEW FIRE TECHNOLOGIES, BORGIAN INTERACTIONS, ETC.) INVOLVED IN THE RWA CONCEPT。

So the Team in China, Assets in China still wants to participate in the issuance of RWA tokens, at a high risk of not only non-compliance but also criminal liability. It is recommended to abandon the RWA dollar narrative, revert to the traditional ABS (asset securitization) or issue traditional bonds in Hong Kong。

In the case of completely offshore enterprises (Global Team, Global Assets), it is still theoretically feasible to cut, including physical and legal, for example:

- Personnel cutting: core team, private key controller cannot be in the mainland。

- Asset cutting:& nbsp; the underlying asset must be an overseas asset (e.g. a united states debt, an overseas property) and not an internal asset。

- Market cutting:& nbsp; Strictly KYC, shielding the continental IP by technical means, does not conduct any publicity on the Internet in brief。

Concluding remarks and perspectives: the path from “zeal” to “source” Hong Kong

In 2025, the RWA market in Hong Kong was subjected to an almost brutal stress test. The process, painful as it may have been, ended with a deep shuffle in the market, from the sight of Project Ensemble at the beginning of the year, to the fever of the mid-year influx of funds, to the freezing and reshuffle caused by tight regulation in the interior at the end of the year。

After the wave, the naked speculators retreated and left behind the seven pillars of our deep analysis:

- HashKey With OSL, the bottom line for compliance transactions and hosting became the “hydro-power coal” of Hong Kong Web3

- Star Road with Assetto demonstrates the feasibility of traditional consortiums using RWA inventory assets

- FireX demonstrates the unique ability of Hong Kong to connect real industries (calculations/energy) with digital finance

- Mantra and AlloyX provide the market with the necessary bottom-link facility and DeFi aggregate liquidity。

IN 2026, THE RWA MARKET IN HONG KONG WILL SHOW THREE MAIN TRENDS:

- "Inner cycle" to "outside cycle": with the closure of capital corridors in the Mainland, Hong Kong will leave the grey illusion of “helping the Mainland fund out of the sea”. Future increases will come mainly from “Global Assets, Distribution in Hong Kong”. That is, using Hong Kong ' s compliance pipeline, United States debt, Dubai property (as in the Mantra case) or global computing (as in the FireX case) are packaged and sold to institutional investors in South-East Asia, the Middle East and Japan. Hong Kong will become a true offshore financial router。

- RWA’s border with DeFi melted (CeDeFi): Simple “asset uplink” is no longer profitable. The core of the next phase of competition is “portfolioability”. We'll see more polymers like AlloyX, using Star Road's tokenization fund as collateral to generate stable currency or leverage on the chain. The compliance CeFi assets will be the highest quality of the DeFi protocol's bottom “Lego blocks”。

- THE STABLE DOLLAR IS THE FINAL BATTLEFIELD OF RWA: all RWA transactions and settlements ultimately point to currency. With the entry into force of Hong Kong's Stabilisation Currency (Stabilisation Currency supported by RWA Assets) legislation, the largest single RWA product will become. Whoever has access to the RWA distribution scene (e.g. FireX's mining proceeds settlement, Asseto's property rent distribution) will have the right to host the Hong Kong dollar/dollar stabilization currency。

THE STORY OF HONG KONG RWA IS NOT OVER, BUT IT HAS JUST TURNED OVER THE PRELUDE TO “BRASH ENTREPRENEURSHIP” AND ENTERED THE BODY OF THE “INSTITUTIONAL GAME”. IN THIS NEW PHASECompliance is no longer a burden, but the biggest asset; technology is no longer a mirage but a vehicle of credit。 hong kong, a city that has evolved throughout the crisis, is redefining the financial centre of the digital age。

Reference List

- Hong Kong Medical Authority (HKMA). Project Ensemble: Wholesale Central Bank Digital Currency (WCBDC) and Tokenisation. Retrieved from

- https://www.hkma.gov.hk/eng/key-finances/international-financial-centre/fintech/central-bank-ministal-currency/project-ensemble/

- Security and Futures Commission. & nbsp;List of Virgin Assembly Trading Platforms

- https://www.sfc.hk/en/Welcome-to-the-Fintech-Contact-Point/Virtual-assets/Virtual-asset-training-platforms-oporators/Lists-of-virt-asset-training-platforms

- Security and Futures Commission. & nbsp;2023). Conventional on intermediaries engaging in tokenisms-relayed acts. Retrieved from & nbsp; https://apps.sfc.hk/disarmamentWeb/gateway/EN/circular/intermediaries/subvision/doc?refno=23EC52

- Financial Services and the Treasury Bureau.& nbsp; (2022)

- https://www.info.gov.hk/gia/general/20210/31/P202103000454.htm

- Hashkey Group.& nbsp; (2024-2025). HashKey Group Newsroom & Official Announcements. Retrieved from

- https://group.hashkey.com/en/newsroom

- OSL Group Limited (Stock Code: 863). Annal Reports and Interim Reports

- https://www1.hkexnews.hk/listconews/index/lsubmit_c.htm?mode=1& code=863

- I DON'T KNOW, OSL. (2024). UBS and OSL Showcase World's First Investment Grade Tokenesed Warrant. OSL Press Release. Retrieved from

- https://osl.com/press-releases/

- UBS.& nbsp; (2024). UBS launches Hong Kong 's first-ever tokenize warrant on Etheum. UBS Global Media. Retrieved from

- https://www.ubs.com/global/en/media/display-page-ndp/en-20240207-tokenized-warrant.html

- FireX.& nbsp; (2025). FireX: Unlocing Bitcoin Hashrate Technical Via RWA. Official Website. Retrieved from

- https://www.firex.vip/

- I DON'T KNOW.& nbsp; (2024). AMTRA Chain: The RWA Layer 1 Blockchain for Industries

- https://www.mantrachain.io/

- Ant Digital Technologies (ZAN).ZAN Web3 Solutions: Identity, KYT and Node Services

- https://zan.top/home

- Star Road Technology.(HK)

- https://www.fosunweather.com/

- (See also: Cyberport Web3 Community Directory)

- I'm sorry, Assetto.& nbsp; (2024). Asseto: Integral RWA Tokenization Information. Official Site. Retrieved from

- https://asseto.ai/ Referenced in HashKey Strategic Investment Announcements)

- Solar Holdings& nbsp; NASDAQ: SWIN. (2025)

- https://investors.solowin.com/

- I'm sorry.& nbsp; (2024). AngelX and BSIM: Bridging Web3 with Real World Information. Conflus Blog. Retrieved from

- https://conflexnetwork.org/blog

- RWA.xyzReal World Assemblys Analytics Dashboard: Treasures & Private Credit. Retrieved from

- https://app.rwa.xyz/

- China Assembly Management.& nbsp; (2024). ChinaAMC (HK) Launches Tokenized Security Investments Fund. Press Release. Retrieved from

- https://www.chinamc.com.hk/en/news/

- Roland BergerTokenization of Real-World Assets: Unloading a New Era of Value Construction.

- I don't know.& nbsp; (2023). Money, Tokens, and Games: Blackchain's Next Billion Users and Trillions in Value. Citi GPS: Global Perspectives &s; Solutions. (Referenced in Market Size Analysis).