Polygon's long-wire layout floated after $250 million in merger cases

The deflation effects triggered by Polymarket are accelerating, but Polygon clearly does not expect it to contribute entirely。

Original Odaily Daily@OdailyChinaI'm not sure

Author Tink@XiaMiPPI'm not sure

On January 13th, Polygon Labs announced that it had completed the acquisition of Coinme and Sequence, the encryption money start-ups, with a total purchase price exceeding$250 millionPolygon Labs, however, refused to disclose the specific purchase price of each company or whether the transaction was carried out in cash, equity or in combination. From the information available, the transaction will proceed in a phased manner: of these, Sequence-related transactions are expected to be completed within the month, while Coinme ' s acquisition will await regulatory approval and will not be finalized until the second quarter of 2026。

"Reverse cyclical actions" in low tide

The Chief Executive Officer of Polygon Labs, Marc Boiron, and the founder of the Polygon Foundation, Sandeep Nailwal, stated that the acquisition was intended to contribute to the stabilization strategy of the network. Specifically, Polygon has been promoting the introduction of stabilization currency, but lacks an indigenous regulatory infrastructure. Coinme's acquisition was just to make up for the short board. As an encrypted financial company based in the United StatesCoinme holds remittance plates covering several states and operates a bitcoin ATM networkThis means that Polygon can use Coinme ' s existing compliance framework to bypass the long approval cycle and directly enter the most regulated United States market. Coinme will continue to operate its current business as a wholly-owned subsidiary of Polygon Labs, including the encryption exchange, wallet and Crystal-as-a-service。

The value of Sequence is more than anything elseArea chain wallet and developer infrastructureLevels. In the Web3 context, wallets are not only an asset storage tool, but also an entry point for users to the entire world chain, their security, ease of use and scalability, directly determining whether the network can carry larger numbers of users and funds. Polygon's acquisition of Sequence was, to some extent, an advanced “user-side” infrastructure for its currency stabilization strategy。

From this point of view, the two mergers and acquisitions of Polygon are based on the same objectiveUpstream/downstream layout: one end is a compliance channel and the other is a user portal。

To bring the perspective back to the industry as a whole, and in the context of the continuing decline of the L2 ecology and the downturn in the market, Polygon has opted for aggressiveness, active self-help and sustained investment of resources for integration and expansion. Behind this counter-cyclical move is the “compliance priority” as a core principle that attempts to take the lead in the broader context of continued tight global regulationTransition from “encrypted infrastructure” to “financial infrastructure”In this way, more traditional funds and institutional users will be attracted to build their own moats。

CHAIN DATA: NOT ALL L2S ARE IN RECESSION

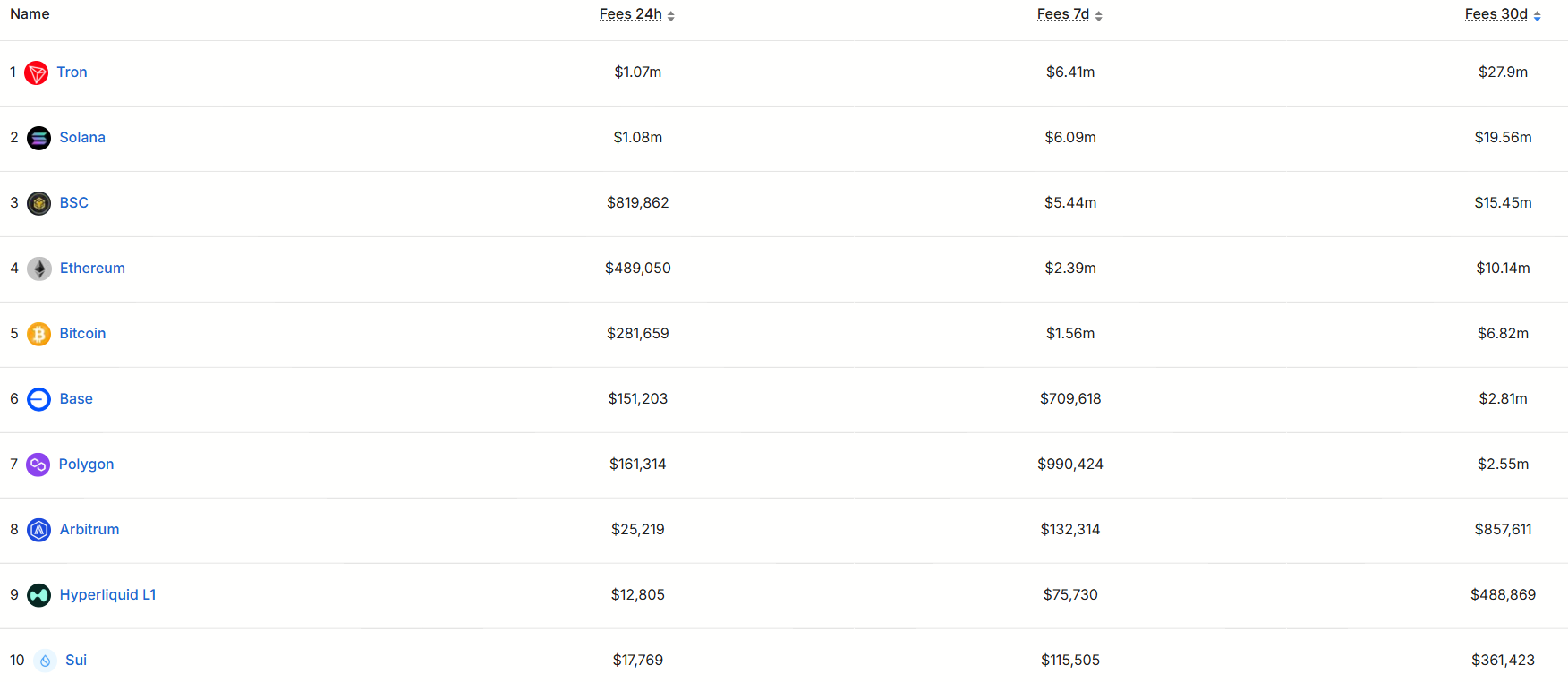

In addition to the strategic layout, Polygon also performed well in the chain. Based oni don't know, defilama.comNearly 30 days of income data for the public chain, Polygon, seventh, still has some resilience in the competitive public chain track。

Of course, the overall gap remains clear. Tron, number one, earned $27.9 million a month, while Sui, number 10, had only $360,000, which is more than the difference77 timesI don't know. The reality is rapidly phasing out the public-chain project “Story-to-Story but Lacking Real Needs” and even the US$ 22.5 million Web3 Wallet company Zerion’s hatching L2 network, Zero Network, which has been out for more than three weeks。

In this contrast, Polygon is at least still active on the cardboard table。

The truth about the sharp rise in revenues: the short-term push of Polymarket

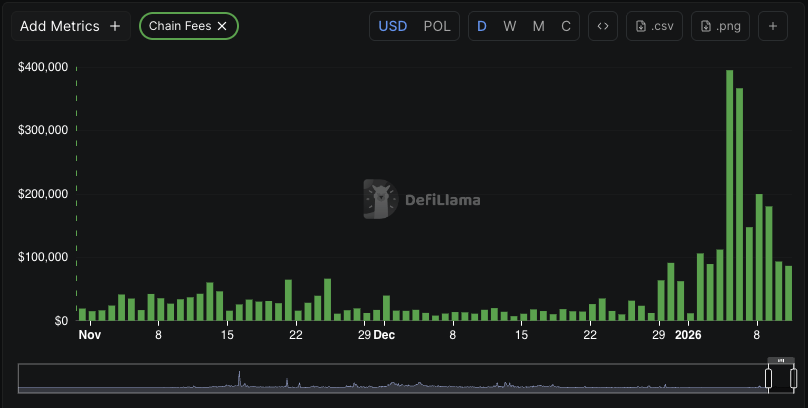

It should be noted, however, that the significant increase in Polygon's fee revenue began only in early 2026. According to Castle Labs' disclosure on 13 January, Polygon ' s current monthly income is close to $1.7 million。

The main driver of income growth in this round came from Polymarket。Since its 15-minute price forecast opened up the fee model (i.e. when the main currencies, such as BTC, ETH, SOL, XRP, increased or fell in the market within the next 15 minutes and settled every 15 minutes), the Polygon network received a daily income of $100,000。

More importantly, Polygon uses a cost-burning mechanism for the POS network, which produces deflation by increasing the volume of transactions and burning the tokens. Since the beginning of the year, Polygon has accumulated its destruction12.5 MILLION POLS VALUED AT APPROXIMATELY $1.5 MILLION OR 0.12 PER CENT OF TOTAL SUPPLYI don't know。

at the current tempo, this trend, if sustained, would result in a destruction rate of about 3.5 per cent in 2026, significantly higher than the annual distribution rate of about 1.5 per cent of the staking incentive, and a reduction in net supply by more than twice the amount of the staking incentive。

Although Polymarket had confirmed through the Discord community in late December 2025 that it would relocate to the self-building of Etheum Layer (known as POLY), the relocation was not immediately completed。In the short term, Polygon will continue to benefit from the high activity of Polymarket, which will drive the deflation effect to accelerate, thereby improving the price of the Pol。

More analysis of their relevance can be found in:The economics behind Polymarket's escape from PolygonI don't know。

Concluding remarks

Taken together, Polygon’s current surge in fees and the burning of tokens are still largely dependent on the phase boom brought about by Polymark; at the same time, however, its long-term strategy around stable currency payments and real world financial infrastructure is falling。

This is probably the most interesting place for Polygon at this point:Short-term data provide confidence in the market and long-term layout determines whether it will remain in the next round of competitionI don't know。